Unveiling the Hidden Gems of Frontier Markets: A New Frontier for Growth-Seeking Investors

In the ever-evolving landscape of global finance, savvy investors are constantly on the lookout for untapped opportunities. While emerging markets have long been a staple in diversified portfolios, a new class of high-potential markets is capturing the attention of forward-thinking investors: frontier markets. These lesser-known economies offer a unique blend of risk and reward, presenting an intriguing proposition for those willing to venture beyond traditional investment horizons.

The appeal of frontier markets lies in their relatively untapped nature. As these economies continue to develop, they present opportunities for early investors to capitalize on burgeoning industries, expanding consumer markets, and improving infrastructure. Moreover, frontier markets often have low correlation with developed markets, providing valuable diversification benefits to investment portfolios.

Understanding the Risks and Rewards

Investing in frontier markets is not for the faint of heart. These markets come with a unique set of challenges, including political instability, limited market liquidity, and less developed regulatory frameworks. Currency fluctuations can also significantly impact returns, adding another layer of complexity for international investors.

However, for those willing to navigate these risks, the potential rewards can be substantial. Many frontier markets are experiencing rapid GDP growth, outpacing both developed and emerging economies. This growth is often driven by favorable demographics, urbanization trends, and increasing foreign investment. As these markets mature, there’s potential for substantial appreciation in both equity and real estate investments.

The Role of Technology in Frontier Market Development

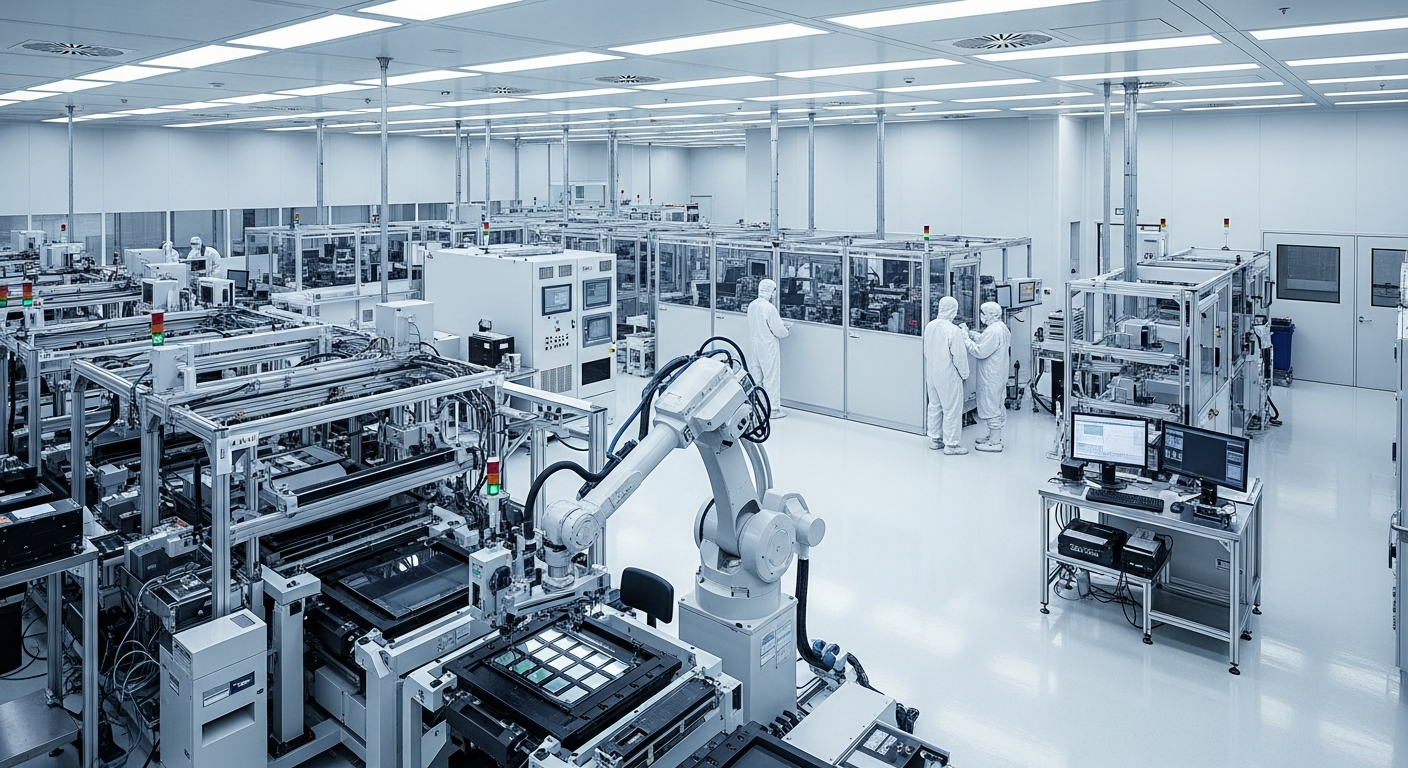

Technology is playing a crucial role in accelerating the development of frontier markets. Mobile banking and fintech solutions are enabling financial inclusion at an unprecedented rate, allowing millions of previously unbanked individuals to participate in the formal economy. This digital revolution is creating new industries and investment opportunities, from e-commerce platforms to digital payment systems.

Moreover, technological advancements are helping frontier markets leapfrog traditional development stages. For instance, some countries are bypassing landline infrastructure in favor of mobile networks, leading to rapid adoption of mobile internet and associated services. This technological leap is opening up new avenues for investment across various sectors, from telecommunications to consumer goods.

Strategies for Investing in Frontier Markets

Approaching frontier market investments requires a nuanced strategy. Here are some key considerations for investors looking to explore this space:

-

Diversification is crucial: Given the higher volatility of frontier markets, it’s essential to spread investments across multiple countries and sectors to mitigate risk.

-

Focus on fundamental analysis: In-depth research on individual companies and local market conditions is vital, as information may be less readily available compared to developed markets.

-

Consider active management: The complexities of frontier markets often make active management a more effective approach than passive investing.

-

Be prepared for the long haul: Frontier market investments typically require a longer time horizon to realize their full potential.

-

Monitor political and economic developments closely: Stay informed about local and regional events that could impact your investments.

The Impact of Global Economic Shifts on Frontier Markets

As the global economic landscape evolves, frontier markets are increasingly influenced by international trends. The ongoing realignment of global supply chains, for instance, is creating new opportunities for frontier economies to attract foreign investment and expand their manufacturing sectors. Additionally, the growing focus on sustainable development is driving investment in renewable energy projects across many frontier markets.

However, these markets are also vulnerable to global economic headwinds. Fluctuations in commodity prices can significantly impact resource-dependent economies, while changes in developed market monetary policies can affect capital flows to frontier markets. Understanding these dynamics is crucial for investors looking to navigate the complexities of frontier market investing.

Expert Insights for Frontier Market Investing

-

Look beyond the obvious: While some frontier markets get more attention, consider less talked about countries that may offer unique opportunities.

-

Leverage local expertise: Partner with local firms or experts who have on-the-ground knowledge of the market dynamics.

-

Pay attention to governance improvements: Countries making strides in improving regulatory frameworks and corporate governance often see increased foreign investment.

-

Consider sector-specific opportunities: Some sectors, like telecommunications or consumer goods, may offer more attractive prospects than others in certain markets.

-

Be mindful of liquidity: Ensure your investment strategy accounts for potentially limited liquidity in frontier market securities.

As the global investment landscape continues to evolve, frontier markets represent an exciting frontier for growth-seeking investors. While these markets come with their own set of challenges, they also offer the potential for significant returns and portfolio diversification. By approaching frontier market investments with a well-informed, strategic mindset, investors can position themselves to capitalize on the next wave of global economic growth. As always, thorough research and a clear understanding of one’s risk tolerance are essential when venturing into these dynamic and promising markets.